Friendly Lien – Guide

Protecting Your Assets with Friendly Liens

Friendly liens are a smart and effective way to shield the equity in your real estate or business assets. Through equity stripping, we help you create strategic liens—such as Mortgages or Deeds of Trust for real estate, or UCC-1 filings for business assets—that can deter potential creditors.

Why It Matters

When someone is considering legal action or a claim against you, one of the first things they often do is check for available equity in your assets. If your property or business holdings show a lot of untapped equity, they become an attractive target. The same applies to equipment, inventory, or other business assets—if they look unencumbered, they’re vulnerable.

By strategically placing liens on these assets, you essentially make them look financially tied up. This discourages would-be creditors from pursuing them, often causing them to look elsewhere.

Making the Strategy Work

There are many equity stripping programs online, but many lack real economic substance or involve unknown third parties holding the lien—something that can backfire if challenged in court.

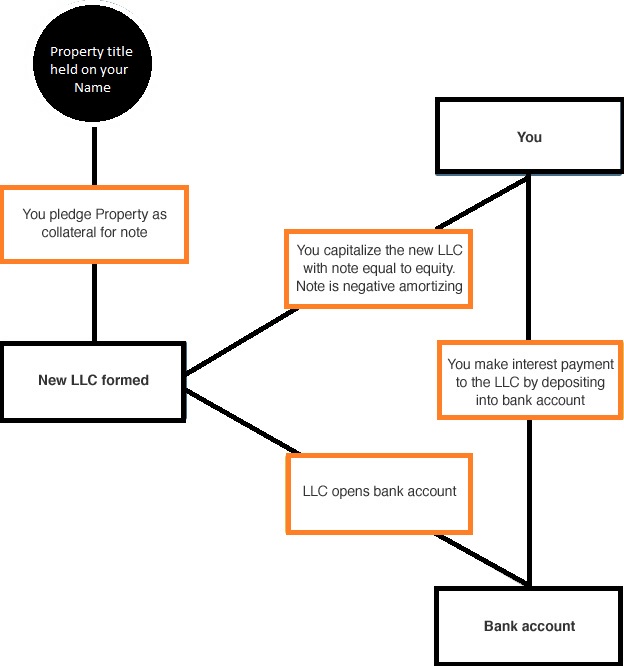

What makes our approach different is that it’s built on solid business rationale. We use capitalization notes, where you fund a separate entity that places the lien. As long as you make regular payments on the note, everything holds up legally and economically.

If you ever need to explain the setup to a judge, it should make perfect sense—because it’s based on real transactions, real structure, and a valid business purpose.

Tax Implications

There are no unusual tax concerns here. The entity holding the lien is either owned by you or passes income through to you, so it’s essentially a wash: what you pay on one side is income on the other. In short, you’re just moving money from one pocket to another.

Setting Up the Lien Entity

We usually form a new entity specifically for placing the lien. We prefer jurisdictions that don’t require the public disclosure of owners or managers, and we choose names that sound like legitimate financial institutions. This adds an extra layer of privacy and credibility to the structure.

You’ve Got to Follow Through

For the friendly lien to stand up to scrutiny, you must respect the structure. That means making regular payments, even if the entity is owned or controlled by you. If you don’t treat the structure seriously, neither will a judge.

But when followed correctly, our clients have seen this method act as a powerful tool for protecting their wealth from outside threats.

What You’ll Need to Provide

To get started, we’ll need to form the lien-holding entity and have you fund it with a note. Then we’ll secure that note with liens on your assets—via a mortgage, deed of trust, or UCC-1 filing.

You’ll need to provide:

- Copies of your property deeds

- A list of business assets

From there, we’ll prepare a full set of legal documents, including:

- The security agreement

- Promissory note

- Entity operating agreement

- Organizational minutes

- Share certificates

Everything will be properly filed with the relevant government agencies to make the liens official and enforceable—giving you peace of mind that your assets are well protected.

FOR MORE INFORMATION PLEASE CONTACT

ASSET PROTECTION, INC.