Trusted Estate Planning Attorney in California: Protect Your Family & Future

Estate planning isn’t just for the wealthy, it’s for anyone who wants peace of mind knowing their assets, healthcare wishes, and family’s future are protected. At Asset Protection Inc., a trusted estate planning firm in California, we help individuals, families, and business owners create customized plans that secure their legacies and minimize legal and financial complications. With the guidance of an experienced estate planning attorney in California, you can take control of your future, avoid unnecessary probate costs, and ensure your loved ones are cared for according to your wishes.

What Is Estate Planning and Why It Matters

Estate planning is the legal process of organizing your assets, healthcare preferences, and financial responsibilities so they are managed and distributed according to your priorities. It covers more than just wills, it includes trusts, powers of attorney, healthcare directives, and inheritance planning.

Without a plan, the state decides who inherits your assets, which often leads to delays, higher costs, and family disputes. With proper planning, you can:

- Protect your assets for future generations

- Reduce estate taxes through estate tax planning

- Ensure healthcare decisions align with your wishes

- Appoint trusted guardians for minor children

- Achieve peace of mind through comprehensive legacy planning

Why Work With Asset Protection Inc.

Choosing the right estate planning firm is one of the most important decisions you’ll make. At Asset Protection Inc., we provide:

- Local California expertise in estate and probate laws

- Customized solutions for inheritance planning and wealth transfer planning

- Guidance from experienced estate planning attorneys and lawyers

- Strategies that help you avoid probate, minimize taxes, and protect your family’s legacy

Our mission is simple: to provide comprehensive estate planning law services that give you peace of mind.

Who Needs an Estate Plan?

Many people believe estate planning is only for wealthy families, but that’s a myth. If you own property, savings, retirement accounts, or even personal belongings of sentimental value, you need a plan. You should consider family estate planning if you own a home or rental property in California, have dependents or minor children, recently married, divorced, or had a child, own a business and need wealth transfer planning, or want to leave assets or donations to charity. In fact, studies show that over 60% of Americans don’t have a will or trust. Without one, your loved ones could face long court battles and unnecessary costs.

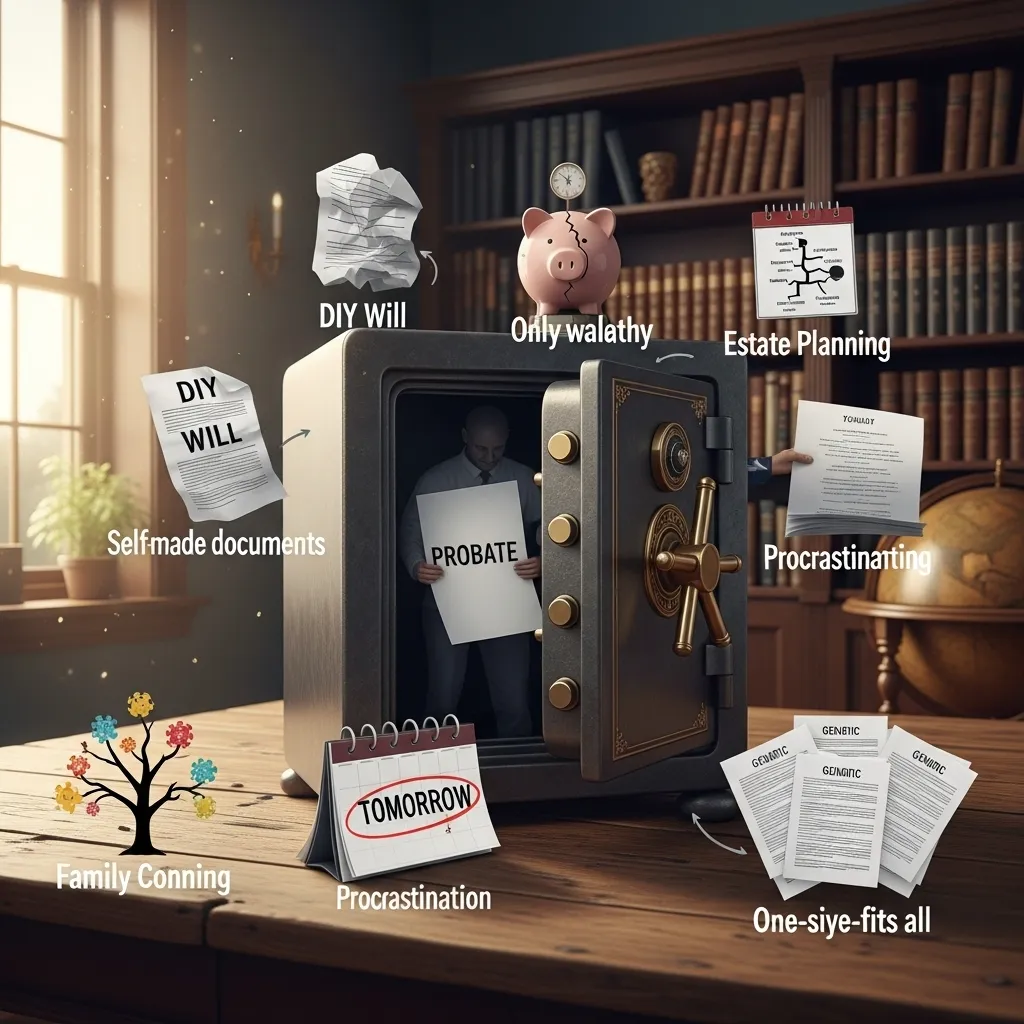

Common Misconceptions About Estate Planning

Many Californians delay estate planning because of myths. Let’s clear them up:

Key Components of an Estate Plan

An effective estate plan combines several legal tools that work together to safeguard your future.

Wills and Trusts

A will ensures your assets are distributed as you wish and names an executor to handle your estate. But wills alone cannot avoid probate.

A living trust, on the other hand, helps bypass probate, saves time, reduces costs, and keeps matters private. Our estate planning law services include preparing revocable and irrevocable trusts tailored to your needs.

Power of Attorney and Healthcare Directives

Through power of attorney services, you can appoint a trusted person to handle your financial affairs if you become incapacitated. Similarly, healthcare directives and a living will attorney help ensure your medical care decisions are honored.

Beneficiary Designations

Updating beneficiaries on life insurance policies, retirement plans, and bank accounts is crucial to ensure your assets are transferred smoothly to the right people.

Many individuals forget to review these designations after major life events such as marriage, divorce, or the birth of a child, which can cause conflicts or delays. Without this step, assets may go through probate unnecessarily, leading to additional costs, longer waiting times, and stress for your loved ones.

Guardianship Planning for Minors

Parents must plan for guardianship in case of the unexpected to make sure their children are cared for by someone they know and trust. Without proper guardianship planning, the courts will decide who takes responsibility, which may not reflect your wishes. Choosing a guardian in advance gives you peace of mind and provides stability for your children during difficult times. It’s an essential part of any family estate planning strategy.

Funeral and Final Wishes

A letter of intent outlining your funeral or memorial wishes can relieve your family from making stressful last-minute decisions during an already emotional time. It allows you to share personal preferences such as burial or cremation choices, service details, or the distribution of sentimental items. While not legally binding, this document provides clear guidance and comfort to your loved ones, helping them honor your final wishes with confidence and peace of mind.

How to Start Planning Your Estate

Getting started may feel overwhelming, but our attorneys simplify the process into manageable steps:

Our estate planning lawyers in California guide you through every stage, ensuring nothing is overlooked.

Minimizing Taxes and Protecting Your Assets

One of the biggest benefits of working with an estate planning attorney in California is reducing taxes and protecting wealth for future generations.

Understanding Estate and Gift Taxes

Federal estate taxes can be as high as 40% for large estates. California doesn’t currently impose a separate estate tax, but planning is still essential to maximize what your heirs receive. (You can learn more about estate tax rules on the IRS website).

Using Trusts to Reduce Tax Burden

Trusts can shield assets from taxation and keep them outside of probate. Options include:

- Revocable Living Trusts: Flexible and adjustable during your lifetime.

- Irrevocable Trusts: Stronger protection and tax benefits.

- Qualified Personal Residence Trusts (QPRTs): Help transfer property to heirs with reduced tax liability.

Charitable Giving Strategies

Charitable remainder trusts and donor-advised funds let you support causes you care about while receiving tax benefits.

Life Insurance in Estate Planning

Life insurance provides liquidity to cover taxes, debts, and expenses. When structured with an irrevocable life insurance trust (ILIT), proceeds may be excluded from your taxable estate.

Get Started With Estate Planning Today

Don’t leave your future, or your family’s future, to chance. Secure your assets, protect your loved ones, and preserve your legacy with Asset Protection. Schedule your estate planning consultation with our trusted attorneys today and take the first step toward long-term security.

Frequently Asked Questions (FAQs)

Conclusion

Estate planning is more than just documents, it’s about protecting your loved ones and ensuring your legacy lives on. With Asset Protection Inc., you’ll get personalized guidance from a dedicated estate planning attorney in California who understands local laws and your family’s unique needs.

Secure your future today. Contact Asset Protection Inc. for a consultation and let us help you build a plan that truly protects what matters most.