Charitable Remainder Trusts (CRTs)

Give with Purpose. Protect with Strategy.

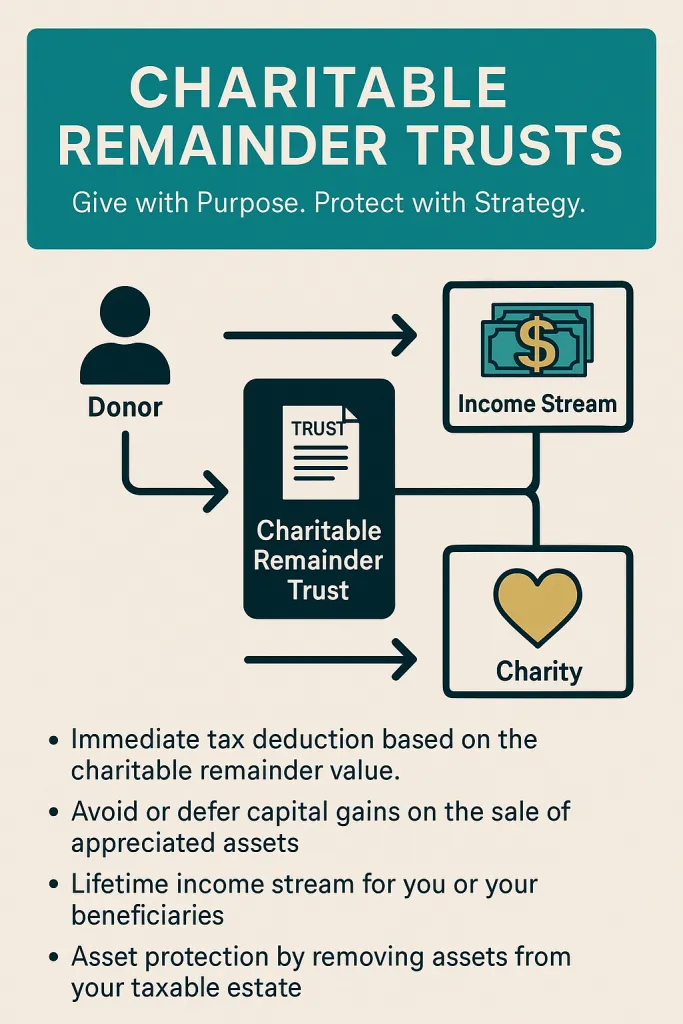

A Charitable Remainder Trust (CRT) is a powerful estate and asset protection tool that allows you to convert highly appreciated assets into income—while reducing taxes and supporting causes you care about.

With a CRT, you transfer assets such as real estate, stocks, or business interests into the trust. In return, you receive a steady income stream for life or a fixed number of years. After the term ends, the remainder goes to a charity of your choice. It’s a smart way to minimize capital gains, reduce estate taxes, and create a lasting legacy.

With a CRT, you transfer assets such as real estate, stocks, or business interests into the trust. In return, you receive a steady income stream for life or a fixed number of years. After the term ends, the remainder goes to a charity of your choice. It’s a smart way to minimize capital gains, reduce estate taxes, and create a lasting legacy.

Key Benefits of a CRT:

- Immediate tax deduction based on the charitable remainder value.

- Avoid or defer capital gains on the sale of appreciated assets.

- Lifetime income stream for you or your beneficiaries.

- Asset protection by removing assets from your taxable estate.

- Philanthropic impact aligned with your values.

Is a CRT Right for You?

If you’re a high-net-worth individual looking to reduce tax exposure, generate retirement income, or support a favorite cause—while protecting your wealth—a CRT may be a strategic option worth exploring.

At Asset.Protection, we help you structure Charitable Remainder Trusts that balance generosity with smart financial planning.

FOR MORE INFORMATION, PLEASE CONTACT

ASSET PROTECTION, INC.