501C Charitable Foundations

Purpose-Driven Giving with Powerful Benefits

A 501(c)(3) charitable foundation is more than just a way to give back—it’s a strategic tool for preserving wealth, reducing taxes, and building a lasting legacy. Whether it’s a private foundation or a public charity, establishing a 501(c)(3) allows individuals, families, or businesses to support causes they care about while enjoying substantial tax advantages.

At Asset.Protection, we help clients structure and maintain compliant foundations that align with their philanthropic goals and financial plans.

Why Create a 501(c)(3) Foundation?

- Tax-Deductible Giving

Contributions to your foundation are generally tax-deductible, which can significantly lower your taxable income. - Asset Protection & Estate Planning

Assets donated to the foundation are removed from your estate, helping to protect wealth from lawsuits, estate taxes, and other risks. - Control Your Charitable Vision

You determine the mission, who receives grants, and how funds are managed—ensuring your giving has lasting impact. - Family Legacy

Foundations are a great way to involve future generations in charitable values, leadership, and financial stewardship.

Types of 501(c)(3) Foundations:

- Private Foundations – Controlled by an individual, family, or corporation, offering full control over charitable activities.

- Public Charities – Supported by the public or multiple sources, typically more collaborative and less regulated in terms of self-dealing and donations.

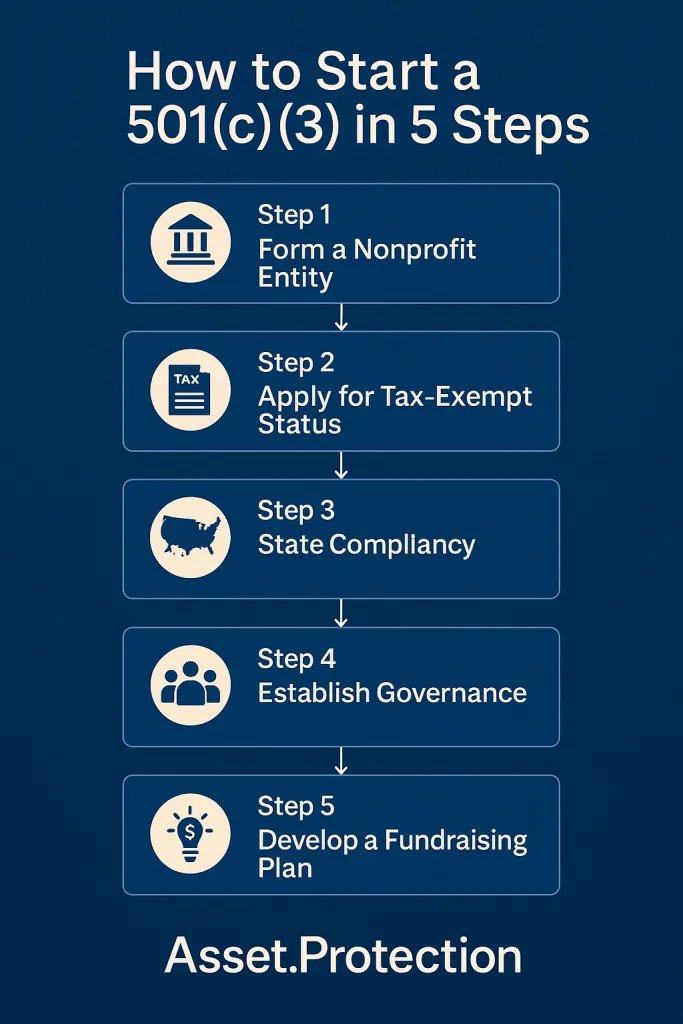

Setting up a 501(c)(3) involves thoughtful planning, IRS compliance, and long-term administration. Our team can guide you every step of the way—from creation and filing to governance and strategy.

FOR MORE INFORMATION, PLEASE CONTACT

ASSET PROTECTION, INC.